#S corporation 2015 software for mac professional#

It’s best to hire a professional to see what you can write off and what you can’t.

For example, maybe you have some unusual tax write-offs.

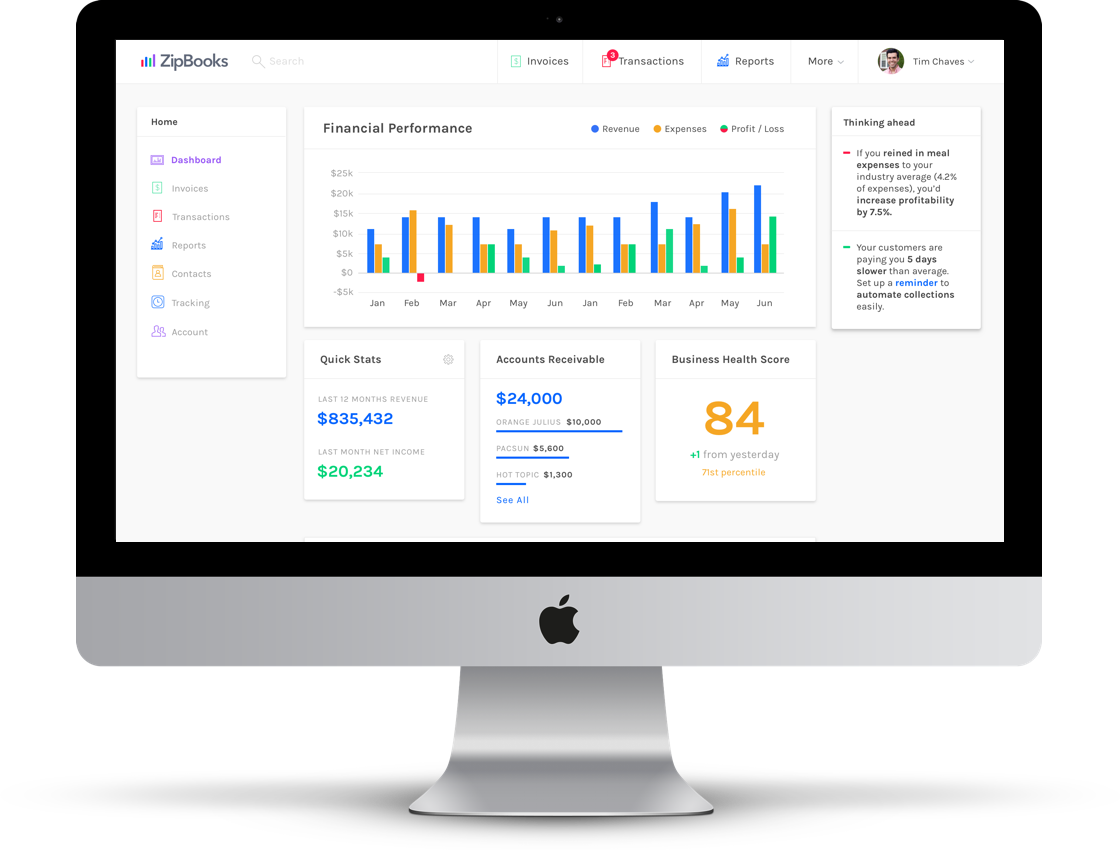

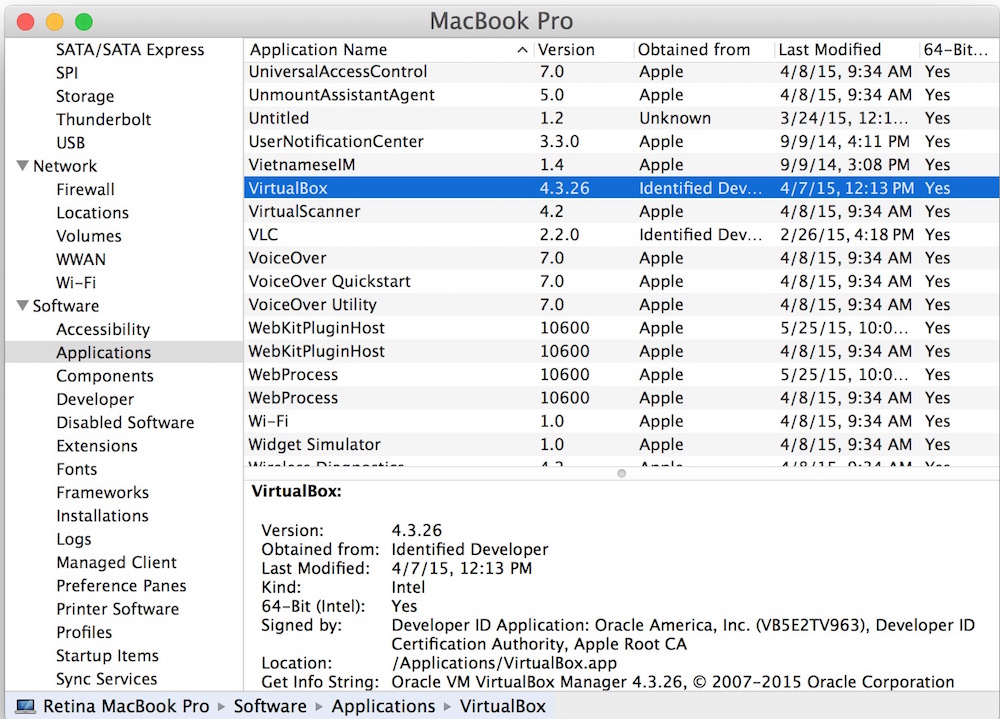

Abnormal Tax Situations Businesses can find themselves in abnormal tax situations. If you're audited, a professional can inform you of the next best steps. Those in a higher income bracket will more than likely get audited than those in a lower income bracket.Even if your taxes are straightforward, a professional will ensure you comply. Your Business Made A Lot of Money Whether you’re a small business owner or a solopreneur, you should plan on hiring a professional if you made more than $100,000. Complicated Business Taxes What if your business taxes aren’t straightforward? For example, you have multiple deductions, several expenses, hire a large staff, and face additional liabilities? It’s best to just hire a professional to ensure you don’t get audited. Here’s when it’s time to hire or outsource an accountant. When to Hire a Professional While there are many resources to make tax filing a breeze, some business owners should hire a professional. Taxes can get complex when you’re married but filing separately, divorced, are the head of a household, and claim dependents.If you’re single, married and filing jointly, and are claiming no dependents, then your taxes are easier and you’re faced with fewer liabilities. Filing Single or Jointly This advice is for solopreneurs and freelancers who report their income on personal taxes. You can easily input your information, your revenue, and your deductions, all in one place.Most tax software will also file your return for you and can track your refund. The software gives you an easy platform to work with. Filing software makes tax time less stressful. You Have Access to Tax Filing Software Tax filing software is your strongest tool when filing business taxes. For personal taxes, the standard deduction is $12,400 for solo filers, $18,650 for heads of households, and $24,800 for married couples filing their taxes together. You’re not filing a business tax return, only including your income on your personal taxes.You can get away with filing your taxes DIY while claiming the. You also don’t want to claim too many deductions and risk an audit.What if your business isn’t eligible for many deductions? You may get away with claiming some simple deductions.Some of these deductions include advertising, bank fees, insurance, business car use, and your home office.What about your personal taxes? Let’s say you’re a freelance or gig worker without an established business. However, these are pretty difficult to calculate. Usual or Standard Deductions Business owners are able to claim a myriad of deductions. You Have Low Income Most businesses don’t generate significant revenue in the first few years of starting their business.As a rule of thumb, if your taxes are straightforward and your earnings are below $50,000 for the year, you can file your own taxes easily.Keep in mind, this usually goes for solopreneurs, startup business owners with only a handful of employees, and freelance/gig workers. you’re a consultant, a web designer, or any business where you had multiple clients throughout the year? If you kept an updated report of your earnings, you can use this information to file your taxes. These forms are straightforward just enter the income you earned and deduct any expenses the client paid for your materials and/or services.What if you have multiple clients i.e. Your client or gig will supply a 1099-MISC form. From the freelance worker to the solopreneur and to the startup business owner, there are more ways to establish yourself as a business without forming a corporate entity.If this sounds like you, you can file your business taxes with ease.Let’s say you’re a freelancer or a gig economy worker. They’re Fairly Simple Business ownership is common today. Here are some ways to know if you can DIY your taxes. But every business owner has different taxes. When to DIY Your Business Taxes For most business owners, doing your own taxes isn’t as intimidating as you think. tax rules.Here’s when you should DIY your small business taxes and when to call a professional. tax code, and it’s impossible for a normal person to know the complex U.S. Tax season is right around the corner.Are you a business owner? Should you hire a professional? It’s tempting there are in the U.S.

0 kommentar(er)

0 kommentar(er)